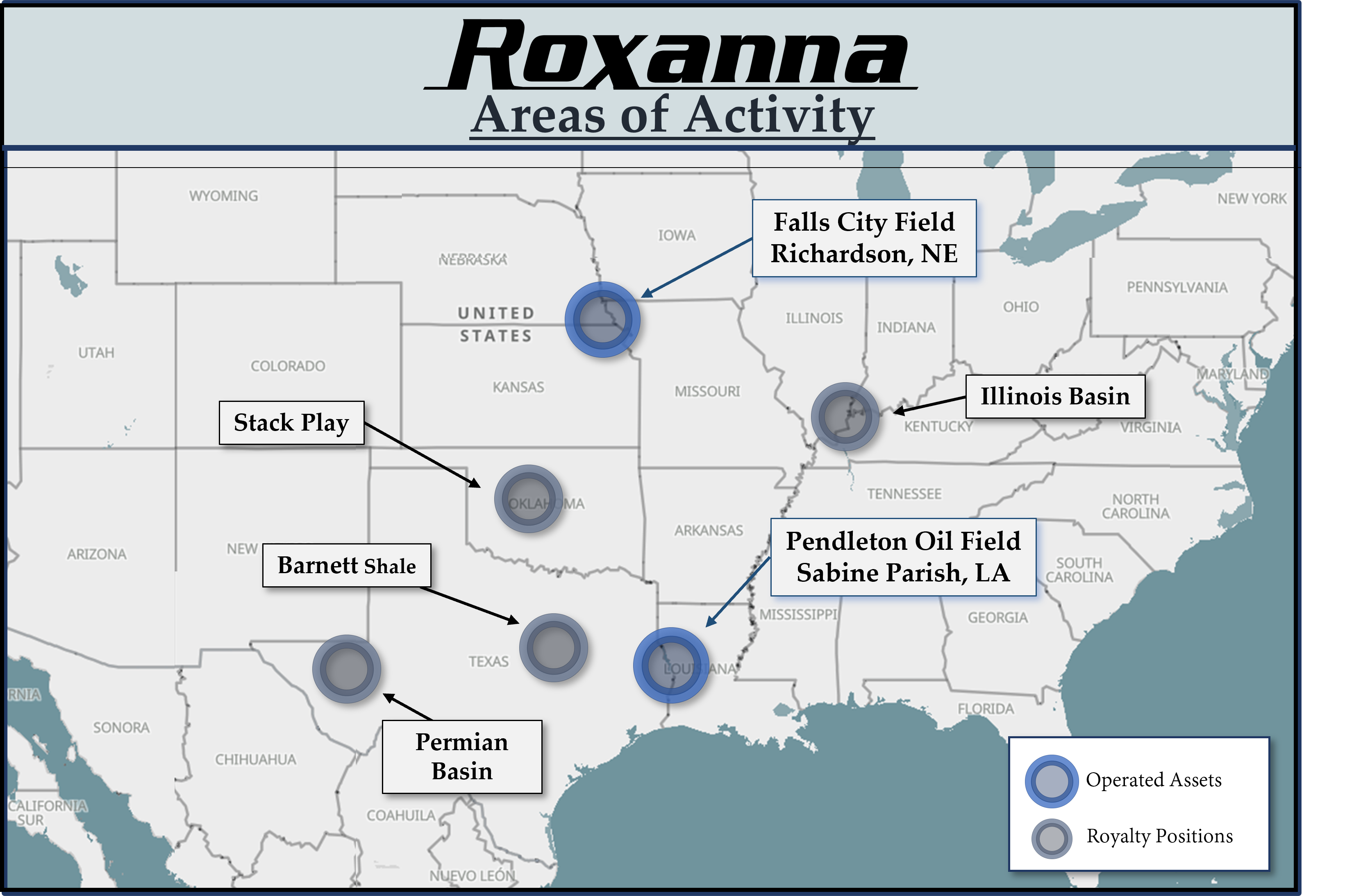

Operated Properties

Pendleton Field, Sabine Parish, LA

Saratoga Fractured Chalk Play

Roxanna has acquired over 25,000 acres in the Pendleton Field targeting discontinuous fractured chalks for horizontal development. This large, 100,000-acre field was initially developed with vertical wells from 1960-1967 and had produced over 40 MMB of 50° API oil before being abandoned. We have successfully drilled two horizontal wells, proving a significant amount of untapped oil remains in place. Roxanna is currently producing 5,000 BO per month, from the 2 wells, making us the largest oil producer in Sabine Parish.

Roxanna Acadia is the operator, and the partnership continues to move forward with the development of the asset.

Fall City Field, Richardson Co, NE

Roxanna acquired a 3,000 acre position in this field targeting discontinuous Hunton limestone formed by karsting of the reservoir that produced over 40 MMBO from vertical wells.

Roxanna successfully steered a 3,000’ lateral targeting unswept oil due to the discontinuous nature of the permeability, by examining cuttings every 10’ and LWD gamma ray to identify the Hunton/Chattanoga boundary to stay in zone and intersect high porosity, oil filled reservoir.

Our water disposal facility and flat production rates has allowed for economic monthly production and doubled the fields total production rate.

We hold a 16%WI, and are operators of the project.

Royalty Interests

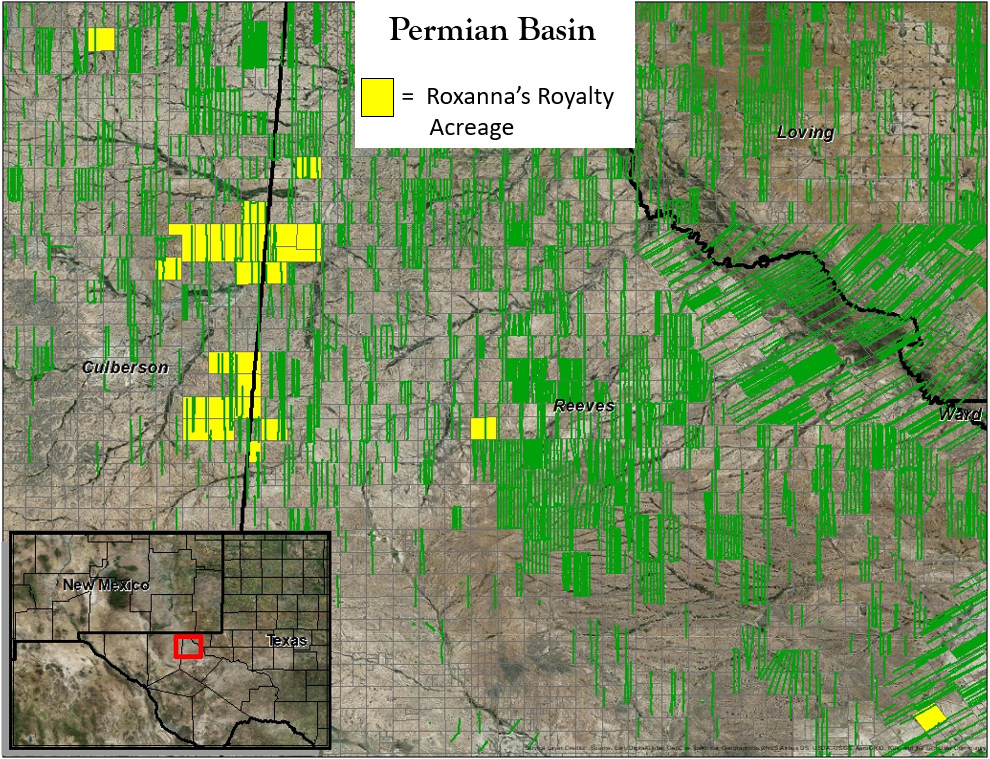

Permian Basin, Reeves and Culberson Co, TX

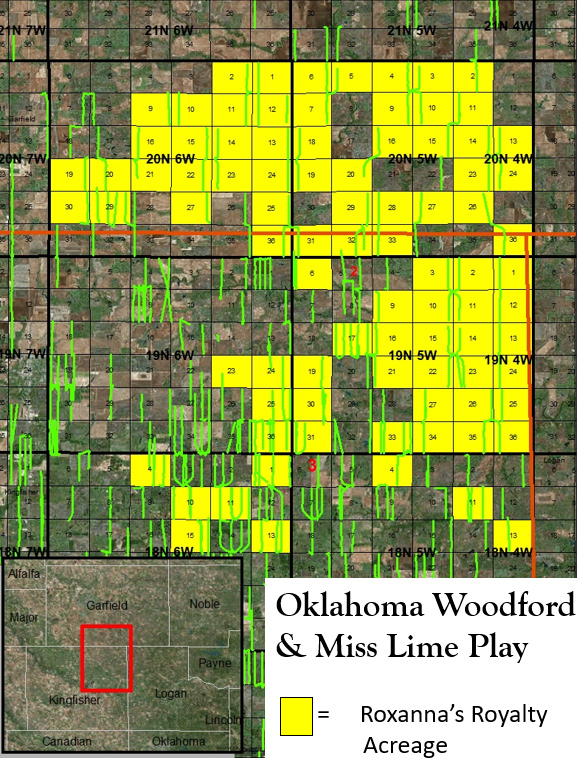

Stack Play, Kingfisher and Garfield Co, OK